Renters Insurance in and around Morgantown

Looking for renters insurance in Morgantown?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Home is home even if you are leasing it. And whether it's an apartment or a townhome, protection for your personal belongings is a good idea, whether or not your landlord requires it.

Looking for renters insurance in Morgantown?

Your belongings say p-lease and thank you to renters insurance

Open The Door To Renters Insurance With State Farm

It's likely that your landlord's insurance only covers the structure of the townhome or space you're renting. So, if you want to protect your valuables - such as a desk, a set of cutlery or a couch - renters insurance is what you're looking for. State Farm agent Robert Jeffers is dedicated to helping you examine your needs and protect your belongings.

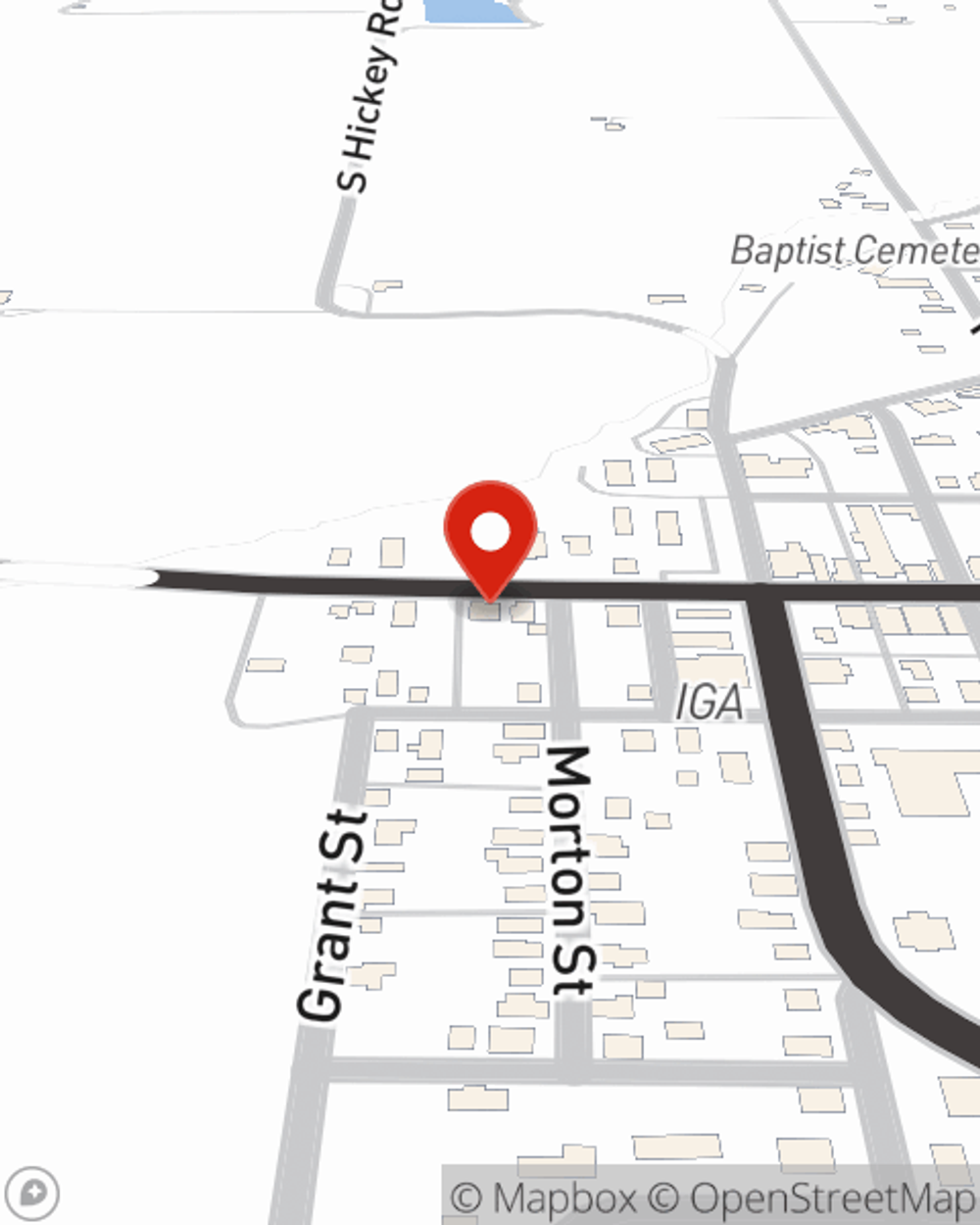

Call or email Robert Jeffers's office to discover how you can save with State Farm's renters insurance to help keep your belongings protected.

Have More Questions About Renters Insurance?

Call Robert at (812) 597-3040 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Robert Jeffers

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.