Homeowners Insurance in and around Morgantown

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

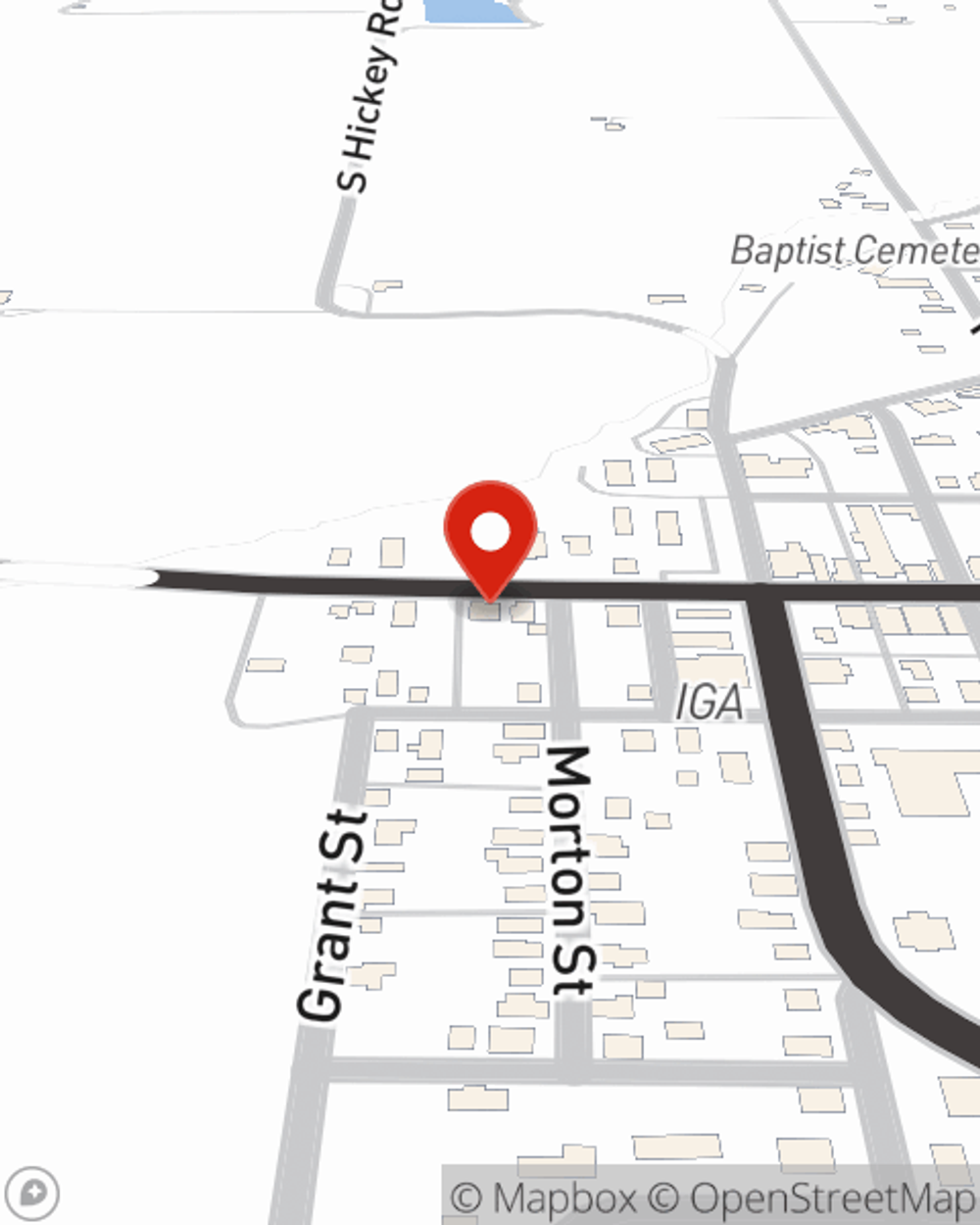

There are plenty of choices for home insurance in Morgantown. Sorting through providers and deductibles isn’t easy. But if you want surprisingly great priced homeowners insurance, choose State Farm. Your friends and neighbors in Morgantown enjoy impressive value and straightforward service by working with State Farm Agent Robert Jeffers. That’s because Robert Jeffers can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as tools, furniture, home gadgets, musical instruments, and more!

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

That’s why your friends and neighbors in Morgantown turn to State Farm Agent Robert Jeffers. Robert Jeffers can help clarify your liabilities and help you make sure your bases are covered.

So contact agent Robert Jeffers's team for more information on State Farm's outstanding options for protecting your home and memorabilia.

Have More Questions About Homeowners Insurance?

Call Robert at (812) 597-3040 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Robert Jeffers

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.